Below are a compilation of Community Inclusion Currency (CIC) user stories from Grassroots Economics Field Support Engineers

- By Shaila Agha

Grassroots Economics has a New Director: Shaila Agha

When I was 9 years old, my mother came home one day with a monopoly board game.

Kakuma Refugee Testimonial

After hearing about sarafu local leaders of a small community group started building a support network in their community

Recycling Debt (Kusaga Deni, Kubali Sarafu)

Imagine having to endure constant reminders and threatening messages from predatory lenders your entire life.

Refugee Economics in Kakuma Kenya

Short description of FHE community based organization.

Kilifi Kenya - a hub for Community Driven Basic Income

The current reality is that following Covid-19 many have fallen deeper and deeper into debt.

- By Will Ruddick

2020 Kenyan CICs Review

Starting in 2010 Grassroots Economics worked with local communities to issue vouchers aka Community Currencies (CCs) as a medium of exchange with the belief that CCs

- By Will Ruddick

Youth Employment via Elderly/Vulnerable Support

Using a basic income (Sarafu in Kenya) youth can support their elderly and vulnerable by giving them their Sarafu.

- By Will Ruddick

Municipal Basic Income(MBI) via CIC

A municipality, town or local administration is an ideal issuer and anchor for a basic/guaranteed income because the have the means to back it and the intention to build sustainable and thriving local markets

- By Will Ruddick

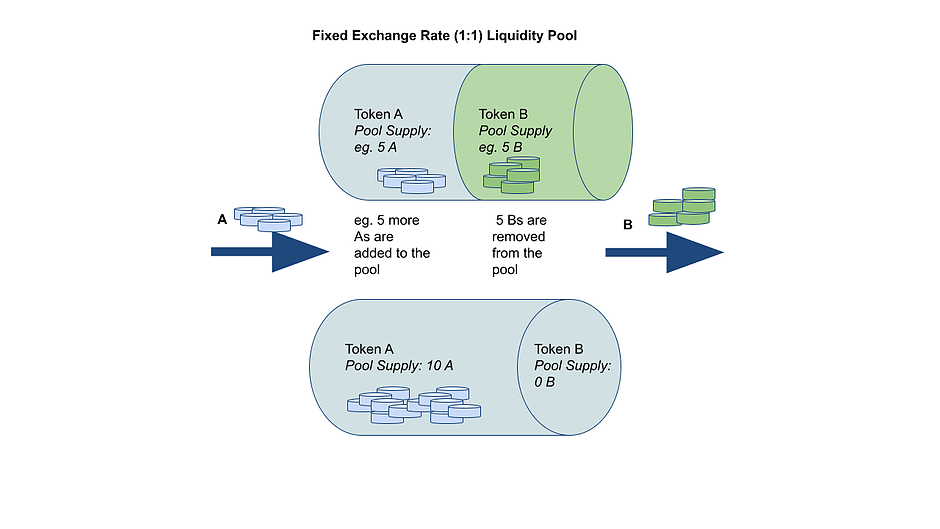

Static vs Bonded Liquidity Pools for CICs

As communities create their Community Inclusion Currencies as a credit against their future production, projects and excess capacity